Here are NerdWallet’s picks for the best small-business accounting software, including why we selected each product, monthly price details and features checklists for easy product comparisons. We’ve also included a couple of accept payments online 2020 solutions that nearly made our list and a few products you can skip. Cloud computing revolutionized the accounting software space, offering users access to their data from any internet-connected device from any location.

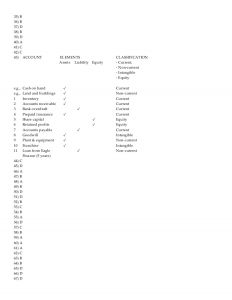

Top cloud accounting software comparison

But its nonprofit solution includes tools for managing records and scheduling events and even includes a donation portal. And because it’s a cloud-based system, you’ll be able to access your real-time accounting and other business data on the go from anywhere. Look for more than just a bookkeeping solution; accounting software should include more detail and let you generate invoices and detailed reports. The Xero Accounting mobile app works in tandem with the Xero accounting software so you can run your small business online from anywhere. Keep track of your unpaid and overdue invoices, bank account balances, profit and loss, cash flow and bills to pay – plus reconcile bank accounts and convert quotes to invoices. If your clients and customers expect you to drive your own car or pay for items out of pocket, then getting reimbursements through expense and mileage tracking is a must.

Accounting Software Features

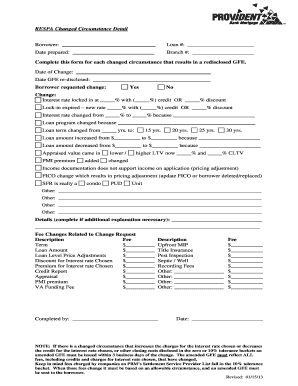

Cloud accounting software provides the same functionality as traditional accounting software, but it connects using the internet to run on remote servers. However, as your business expands, you will want your accounting software with inventory management, that can manage vendors and assist you with purchase ordering when selling more products. While some software offer remote accessibility with their mobile app, others provide separate apps for employees and equip them with time-tracking, expense receipt-submitting, and other functionalities. FreshBooks is a cloud-based accounting and invoicing solution with a user-friendly interface that allows you to automate invoice reminders, payment collection, and other operations while handling your basic bookkeeping needs. Intacct provides editable invoice templates in Microsoft Word format and integrates with payment processors like Paya and EBizCharge to accept credit card, debit card, and eCheck payments. However, you’ll need the help of a value-added reseller or VAR for implementation, support, and customizations.

- Advanced features include double entry, payroll integration, project cost tracking, customization options and the ability to collaborate with an accountant.

- The comprehensive package includes help with accounting, invoicing, payroll, benefits and expense-tracking needs.

- Since mobile apps vary in this way, you need to check if the software you’re aiming for has the capabilities you’re looking for.

- However, a huge downside is that it doesn’t provide live chat support like QuickBooks, FreshBooks, and Zoho Books do.

- You will also save money on an in-house IT team to do things like upgrade software or deal with other technical issues.

Accounting software shouldn’t be a chore to use

However, our research also revealed some considerations for potential users. QuickBooks’ pricing, which ranges from $30 to $90 per month, can be cost-prohibitive for very small teams and freelancers. Like most cloud-based accounting software, it operates on a subscription-based pricing model.

In some cases, we earn commissions when sales are made through our referrals. These financial relationships support our content but do not dictate our recommendations. Our editorial team independently evaluates products based on thousands https://www.simple-accounting.org/what-is-stockholders-equity/ of hours of research. Easily create and send invoices and automate invoice reminders for a quicker, hassle free payment. Desktop accounting applications might be on the way out, so transitioning to cloud accounting is a smart choice now.

What Are the Benefits of Cloud Accounting?

You can also track the cost of goods sold and adjust inventory for loss or shrinkage. If you don’t want to manually enter transactions into Wave, you can opt for the Pro plan to link an unlimited number of bank and credit card accounts for automated reconciliation. The paid plan offers more competitive online payment processing rates, too (starting at 2.9% per transaction vs. the free plan’s 2.9% + $0.60 per transaction). Sage 50 Accounting, unlike some of its competitors, offers inventory management and job costing features at all plan levels. Also included with every plan is Sage’s own cybersecurity offering, which will keep tabs on your business credit score and monitor for data breaches.

The platform offers clear visibility into bank and credit card data to help forecast cash flow. Additionally, it consolidates financials for multi-company environments and generates graphical dashboards for revenue trends, profit margins, and accounts receivable and payable. Xero is a great option for businesses with multiple users, especially those needing excellent inventory management features. Unlike most similar software, you can add as many users as needed for free in all its plans.

Reporting capabilities increase with each plan, but even the least expensive Simple Start plan includes more than 50 reports. Xero’s project-based billing tools are ideal for businesses that need to track materials and labor costs, ensuring each project stays on track and profitable. We collaborate with business-to-business vendors, connecting them with potential buyers.

While we found NetSuite offers advanced tools and capabilities beyond many cheaper alternatives, the UI can be quite busy and might require some time to navigate effectively. Additionally, business owners may need to engage a consultant to leverage NetSuite’s extensive features fully. In 2024, FreshBooks introduced several enhancements, including a partnership with Gusto for FreshBooks Payroll. https://www.simple-accounting.org/ This allows U.S. businesses to handle payroll, tax filings, and labor compliance within the platform. Additionally, FreshBooks integrates with over 100 third-party apps, though point-of-sale integration options are limited. To help you organize your documents online, you can use Xero’s online file storage feature to upload files to bills, invoices, receipts, inventory items, and contact records.

Focusing on bringing growth to small businesses, she is passionate about economic development and has held positions on the boards of directors of two non-profit organizations seeking to revitalize her former railroad town. Prior to joining the team at Forbes Advisor, Cassie was a content operations manager and copywriting manager. You don’t need to know different accounting practices, formulas, or shortcuts as you would if you used an excel sheet.